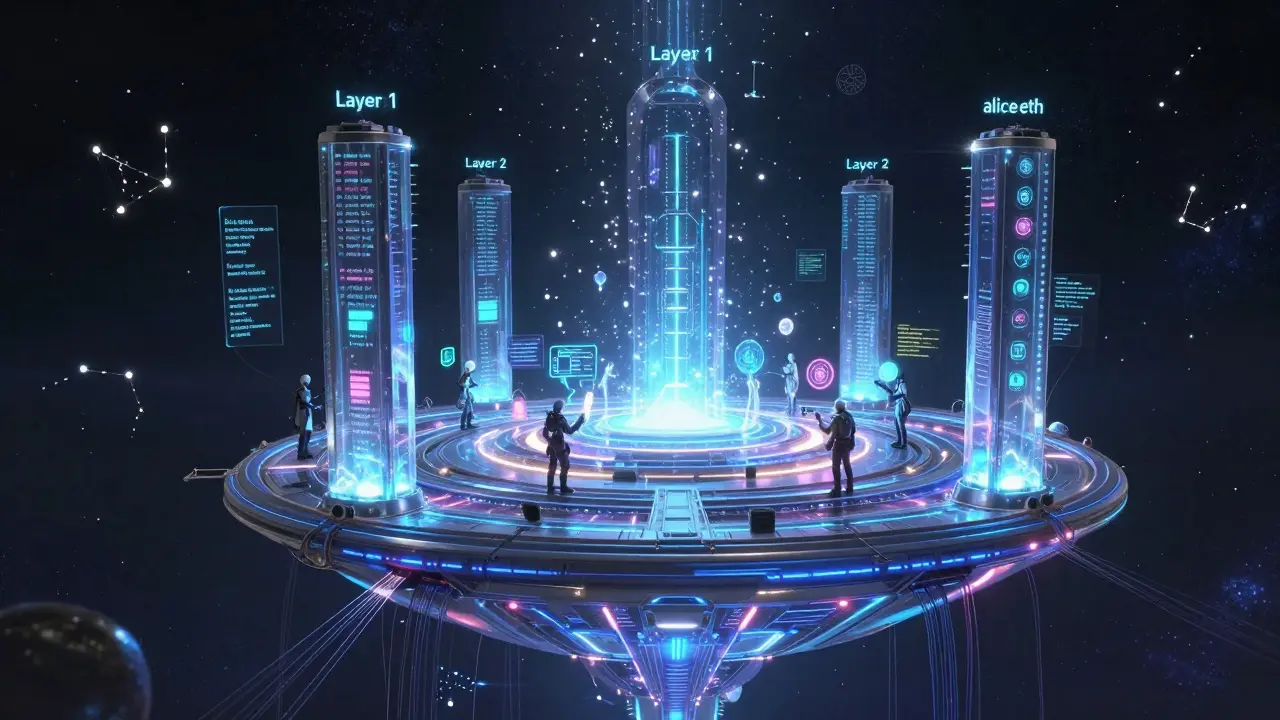

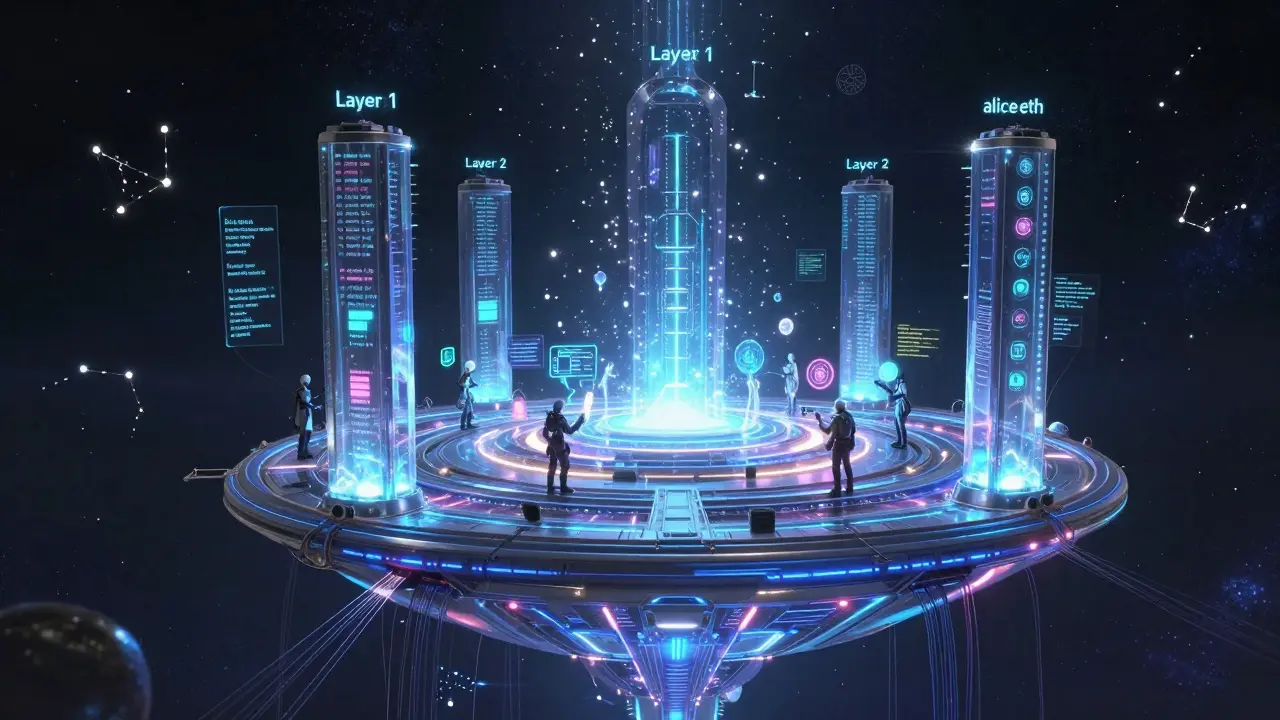

Web3 isn't just crypto - it's a layered technology stack that powers decentralized apps. Learn how blockchain, smart contracts, and decentralized storage work together to replace centralized systems.

When you hear blockchain, a distributed digital ledger that records transactions across many computers so that any involved record cannot be altered retroactively. Also known as distributed ledger technology, it’s the invisible engine behind Bitcoin, DeFi apps, and even how governments now track crypto. It’s not just a tech buzzword—it’s the reason you can send crypto without a bank, borrow money without collateral, and still know the transaction is real.

That same blockchain, a distributed digital ledger that records transactions across many computers so that any involved record cannot be altered retroactively. Also known as distributed ledger technology, it’s the invisible engine behind Bitcoin, DeFi apps, and even how governments now track crypto. is what lets flash loans, a type of uncollateralized loan in DeFi that must be borrowed and repaid within a single blockchain transaction work. You don’t need to put up cash upfront—but you *must* pay it back before the transaction ends, or the whole thing cancels. That’s only possible because of how blockchain verifies every step in real time. It’s also why crypto regulations, national and international legal frameworks that classify crypto as securities, commodities, or payment tools are now a big deal. The EU’s MiCAR, the SEC’s rules, and Asia’s different approaches all try to fit crypto into old financial systems built on banks, not blockchains.

And then there are the whale wallets, crypto addresses holding massive amounts of digital assets that can move markets with a single transfer. These aren’t random accounts—they’re institutions, early adopters, or even funds that control billions in Bitcoin or Ethereum. When one moves, prices shake. Why? Because every transaction is public on the blockchain. You can see it. Track it. And if you know how to read it, you can see what’s coming before the market does.

What you’ll find below isn’t just theory. These posts show you how it all connects: how a single flash loan can exploit a DeFi glitch, how a new law in Brussels affects your wallet, and how a whale’s move can trigger a ripple across hundreds of coins. No fluff. No jargon. Just the real mechanics behind what’s happening right now on the blockchain.

Web3 isn't just crypto - it's a layered technology stack that powers decentralized apps. Learn how blockchain, smart contracts, and decentralized storage work together to replace centralized systems.

Quantum computing could break the encryption protecting Bitcoin and other blockchains, but the threat isn't immediate. Learn how Shor's algorithm works, why address reuse is dangerous, and what's being done to make blockchain quantum-resistant.

Trusted and trustless blockchain bridges enable cross-chain asset transfers but differ in security, speed, and trust models. Trusted bridges are faster but vulnerable to hacks; trustless bridges are slower but more secure. Learn which to use based on transfer size and risk tolerance.

Music rights management on blockchain automates royalty payments, eliminates delays, and gives artists full ownership control through smart contracts and immutable ledgers. No more waiting years for payments.

Blockchain insurance uses smart contracts to automate claims, cut fraud, and speed up payouts - especially for flight delays, crop damage, and crypto theft. It’s not everywhere yet, but it’s already changing how insurance works.

Privacy-preserving identity verification uses blockchain and cryptography to prove who you are without exposing your personal data. Learn how zero-knowledge proofs and decentralized IDs are replacing risky, outdated systems.

In 2025, international crypto regulations have shifted from chaos to clarity. Learn how the U.S., EU, Asia, and others now treat crypto as securities, commodities, or payment tools-and what it means for your investments or business.

Whale wallets hold massive amounts of crypto and can swing markets with a single transaction. Learn how they work, who they are, and how to protect yourself from their impact.

Flash loans let you borrow crypto without collateral-but only if you repay it in the same transaction. Learn how Aave, Uniswap V3, and others implement them, the technical requirements, common mistakes, and how to build your own safely.