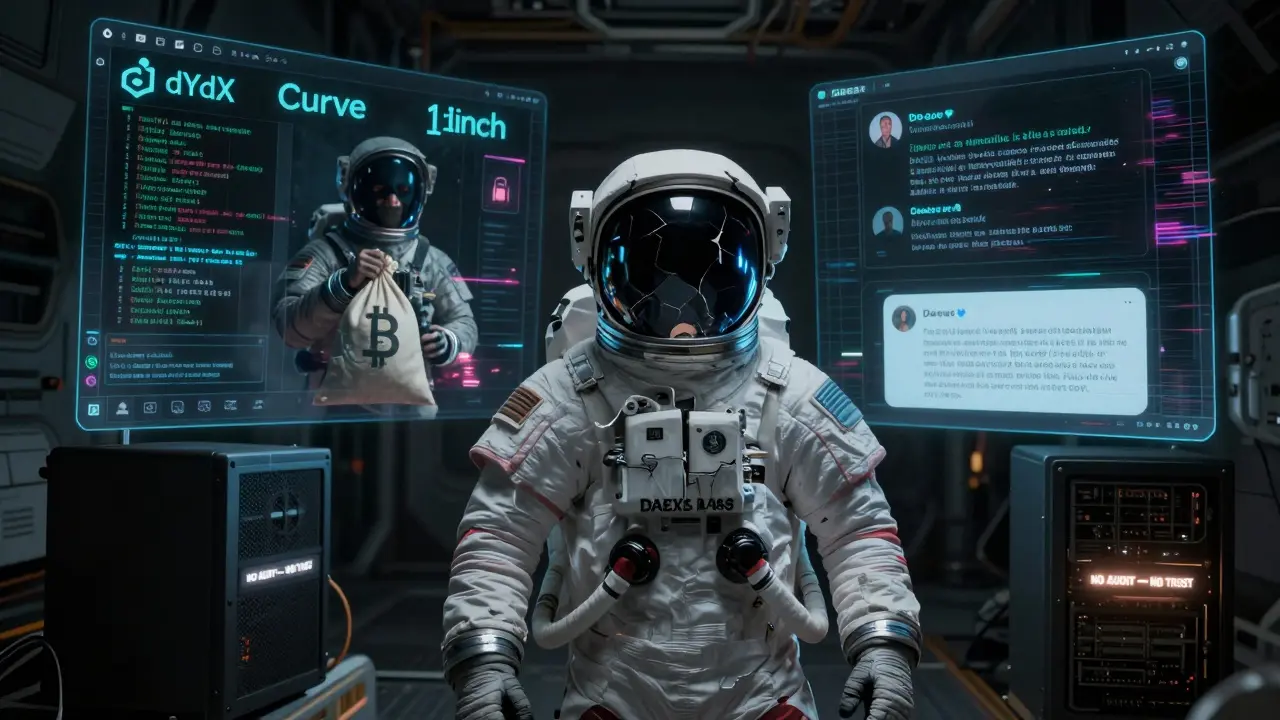

There’s no verified information about Daexs Exchange as a functioning crypto platform in 2026. Despite extensive coverage of decentralized exchanges (DEXs) this year - including deep dives into Uniswap, PancakeSwap, dYdX, and Curve - Daexs Exchange doesn’t appear in any major industry reports, blockchain analytics dashboards, or user forums. If you’re looking to trade on Daexs, you should proceed with extreme caution.

What you won’t find on Daexs Exchange

Most legitimate crypto exchanges publish clear details: their team, headquarters, audit reports, supported tokens, fee structures, and wallet integrations. Daexs Exchange offers none of this. No official website with verifiable domain registration. No GitHub repository showing open-source code. No liquidity pool data on DeFiLlama or Dune Analytics. No user reviews on Trustpilot or Reddit’s r/CryptoCurrency. If it were real, it would be visible.

Compare that to real DEXs. Uniswap, for example, has over $4 billion in total value locked (TVL), transparent smart contracts audited by Trail of Bits, and a public governance token (UNI) that lets users vote on protocol changes. PancakeSwap runs on BNB Chain with over $2 billion TVL and clearly lists its fee structure: 0.25% per trade, with 0.17% going to liquidity providers. These platforms don’t hide. They advertise their numbers because trust is their product.

Why Daexs Exchange might be a scam

Scammers often create fake exchange names that sound technical or brand-like - Daexs, Dexa, Zynex, NexoSwap - hoping users will confuse them with real platforms. These names are designed to look legitimate at a glance. They might use a .xyz or .io domain, copy UI elements from Uniswap, and post fake testimonials on Twitter or Telegram. Some even create YouTube videos showing fake trading results to lure in new users.

If Daexs Exchange asks you to deposit funds to start trading - especially in ETH, USDT, or BTC - you’re likely being targeted. Once you send crypto to an unknown contract, there’s no way to reverse it. No customer support. No chargeback. No legal recourse. You lose everything.

Real exchanges don’t operate like this. Even smaller DEXs like SushiSwap or Osmosis have public teams, documented roadmaps, and community governance. They don’t rely on mystery. They build trust over time.

What real DEXs look like in 2026

If you’re looking for a decentralized exchange that actually works, here’s what to expect:

- Uniswap V3 - Dominates Ethereum. Offers concentrated liquidity pools, dynamic fees from 0.05% to 1%, and integrates with MetaMask, Coinbase Wallet, and WalletConnect. Trades over $1.2 billion daily.

- PancakeSwap - Top choice for BNB Chain users. Supports over 500 BEP-20 tokens. Offers yield farming, staking, and lottery. Fees: 0.25% flat. Mobile app available.

- dYdX - For advanced traders. Offers perpetual futures with up to 20x leverage. No spot trading. Fees: 0.00% to 0.05% based on volume. Built on Ethereum Layer 2 for lower gas costs.

- Curve - Best for swapping stablecoins like USDT, DAI, and USDC. Slippage under 0.1%. TVL: $4 billion. Used by institutional traders.

- 1inch - Not a DEX itself, but an aggregator. Searches 15+ DEXs to find the best price. Saves users money on large trades.

These platforms have been around for years. Their contracts are audited. Their tokenomics are public. Their development teams are known. You can trace every transaction back to a verified address.

Red flags to watch for

If you stumble across Daexs Exchange or something similar, look for these warning signs:

- No whitepaper or technical documentation

- Website built with a template (look for copy-paste errors or stock images)

- Only accepts deposits - no withdrawal options listed

- Uses Telegram or Discord as main support

- Claims “guaranteed returns” or “high APY with no risk”

- Domain registered less than 6 months ago

- No social media presence beyond a few bot accounts

One real example: In late 2024, a fake DEX called “ZynexSwap” tricked over 800 users into depositing $2.3 million. The site looked identical to Uniswap. The contract address was hidden behind a “Click to Connect Wallet” button. Within 48 hours, all funds were drained. No one was ever caught.

How to stay safe

Here’s how to avoid falling for fake exchanges like Daexs:

- Only use DEXs listed on DeFiLlama or Dune Analytics. These sites track real TVL and transaction volume.

- Check the contract address on Etherscan or BscScan. Look for verified code and audit reports.

- Never connect your main wallet to unknown sites. Use a burner wallet with only the amount you’re willing to lose.

- Search for “Daexs Exchange scam” on Google or Reddit. If others are reporting losses, it’s a scam.

- If a platform doesn’t have a clear team, email, or physical address - walk away.

There’s no shortcut to safety in crypto. The most secure exchange is the one you can verify - not the one that promises fast profits.

What to do instead

If you want to trade crypto without risking your funds, start with established platforms:

- For beginners: Use Coinbase or Kraken. They support fiat on-ramps, have simple UIs, and are regulated in the U.S.

- For DeFi users: Start with Uniswap or PancakeSwap. Connect your wallet, swap a small amount of ETH or BNB, and learn how gas fees and slippage work.

- For traders: Try dYdX or Hyperliquid. They offer advanced tools without custodial risk.

Don’t chase unknown names. The crypto space rewards patience, not hype.

Is Daexs Exchange a real crypto exchange?

No, Daexs Exchange is not a real or verified crypto exchange. As of 2026, there is no credible evidence it exists as a functioning platform. No blockchain data, no public team, no audits, and no user activity on major analytics tools. It’s likely a scam site designed to steal crypto deposits.

Can I trust Daexs Exchange if it looks like Uniswap?

Appearance doesn’t equal legitimacy. Scammers copy the UI of real DEXs to trick users. Even if the site looks professional, check the contract address on Etherscan. If it’s not verified, has no transaction history, or was created recently - it’s fake. Never trust a site just because it looks real.

What should I do if I already deposited crypto to Daexs Exchange?

If you’ve sent funds to Daexs Exchange, your crypto is likely gone. Blockchain transactions are irreversible. Immediately stop using the site, disconnect your wallet, and change passwords on all related accounts. Report the incident to your local financial crime unit and file a report on the FTC’s website. There’s no recovery service - prevention is the only defense.

Are there any legitimate exchanges with similar names?

There are no major DEXs with names like Daexs, Dexa, or Zynex. Legitimate platforms use clear, consistent branding: Uniswap, SushiSwap, Curve, dYdX. If a name sounds slightly off - like a typo of a real one - it’s almost certainly fake. Always double-check spelling before connecting your wallet.

Why don’t I see Daexs Exchange on DeFiLlama or CoinGecko?

DeFiLlama and CoinGecko only list platforms with verifiable data: active contracts, real TVL, audited code, and consistent transaction volume. Daexs Exchange has none of these. If it were real, it would appear in these databases. Its absence is the strongest signal that it’s not legitimate.

Stick to well-known platforms. Avoid anything that feels secretive, too good to be true, or lacks public verification. In crypto, your safety is your responsibility - and ignorance is the biggest risk.

I'm a blockchain analyst and crypto educator who builds research-backed content for traders and newcomers. I publish deep dives on emerging coins, dissect exchange mechanics, and curate legitimate airdrop opportunities. Previously I led token economics at a fintech startup and now consult for Web3 projects. I turn complex on-chain data into clear, actionable insights.